|

|

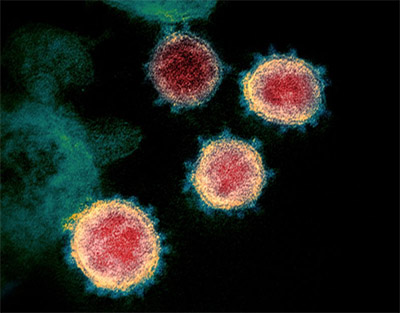

Image of the coronavirus taken with an electron microscope |

I probably shouldn’t write this. It goes against some of the themes I addressed in the essay two weeks ago. Instead, I should probably write something about some aspect of evolution, astrophysics, or other interesting (to me) areas of science. Or something merely tangential to the underlying conditions of our current politics and economics. Or something about writing novels—which I should also be doing right now. But I am too heartsick at the present state of affairs to do any of that. So here goes.

“Did IQs just drop sharply while I was away?”1 We have a virus of unknown but suspect origin, of unknown but worrisome characteristics concerning its transmissibility, symptoms, detection, and causes of mortality, and of unknown presence in the general population due to lack of universal testing. Some people claim that the “bad cold” with a “persistent cough” that was going around in December and January—I myself had a bout—was this same coronavirus but of unrecognized origin and status. Some people claim that this is a bat virus under study in a Chinese virology lab that got out and into the general population. Some still think it was a crossover from a bat in the nearby “wet market.” And the Chinese government is claiming this is a U.S. bioweapon that we launched against their country and that has now come back to bite us in spades. Meanwhile, some U.S. senators were given a confidential briefing—presumably about this virus—and immediately dumped their stock portfolios, as if the end times were at hand.

Everybody knows. Nobody knows. We live in contaminated times.

Back in March2 I was not unduly alarmed when the six Bay Area counties—closely followed by governor of California, for the whole state—ordered us all to “shelter in place” so as to “flatten the curve” of viral transmission. That made sense at the time. I gave the process two weeks, maybe three, just until the crisis had passed. I thought we could all do without sit-down meals in restaurants, movies in the theater, and shopping expeditions at the mall for at least that long. We could do with the schools being closed for a week or two, or even to the end of term. At the time, the president thought things would probably be back to normal by now.

But as I write this (admittedly about a week before the above posted date), and now in the third week of the general shutdown, and with the Bay Area counties extending their sheltering orders for another month, to the beginning of May, the emergency measure is starting to look like a new economic reality. People who worked in those restaurants, movie and sports complexes, shopping malls, and so many other places deemed as “non-essential” services are now being laid off. Utilities, once a safe refuge in the stock market, are taking a hit because they expect to experience massive non-payment of their bills in April. Banks are preparing for people to stop paying off their mortgages, and landlords for people to come up short on the month’s rent—all while some cities are already ordering a halt to all foreclosures and evictions. The consumer economy that was doing so well in January and early February just hit a wall and came to a stop.

And now people are generally suggesting that the shutdown and its effects could probably go on—should go on, will go on—for another three months at least. That takes us up to June or July. That will mean massive layoffs in collateral industries—I’m already hearing projections of double-digit unemployment—and jobless claims not experienced since the Great Depression. That will mean total disruption of personal and family finances, of mortgage banking, of the real estate market, and of the country’s service infrastructure. For the past couple of years, I’ve been hearing in the financial news that the strength of the U.S. and even the global economy is the U.S. consumer: we keep buying the world’s goods—the new car, the next iPhone, the latest fad, and then its upgrade—and this keeps the wheels of the world economy turning. Well … if you shoot the U.S. consumer in the head, all of that goes away, doesn’t it? This is an economic collapse that a mere two trillion dollars in emergency funding won’t cover.

If the shutdown goes on for eight to eighteen months—as some health officials are promising, to keep the currently isolated and uninfected population from ever experiencing the effects of this virus until a vaccine can be manufactured, tested, and put into general use—then we risk a political collapse as well as an economic one. Eventually people are going to venture out, and to keep them contained will require curfews, active enforcement by police and safety personnel, and ultimately martial law. Already, what was framed as voluntary shelter-in-place measures are now, in some areas, backed up with misdemeanor charges and fines for non-essential services that are still operating and even for isolated people who go out to exercise. The mayor of Los Angeles is now asking average citizens to anonymously report on neighbors who leave their homes. How soon before we have the National Guard patrolling the streets?

This is madness—or at least portends it. This is throwing our economy, our lifestyle, our culture on the bonfire of primal fear over a set of infection and mortality statistics that is widely variable by country and by state. Those who say that no amount of economic damage—mere money, just “the stock market”3—matters if it saves one life are not counting the cost in ruined lives and displaced families. Future fear is about to become present hurt.

Maybe we don’t deserve the good economy—more jobs, more income, more opportunities—that we’ve enjoyed over the last decade. Maybe it was all a dream, a fantasy, an illusion. But that would be a real shame. Because the downside is going to hurt more than we can imagine.

1. One of my favorite quotes from the eminently quotable movie Aliens.

2. As if the burgeoning health crisis and the stock market crash that followed it are now lost in the mists of February …

3. Where the market represents the valuation of, and ultimately the economic health of, the organizations that provide most of this country with jobs, material wealth, and retirement savings.